Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Initially my VDHG investment was making regular 0.4% gains each day and it was looking like a nice a stable investment. I bought at about $60.10, and after reaching $60.70 it began its plummet to $56.87. A quick 6.4% drop. It is still continuing to drop and there is a lot of uncertainty around the potential effects of the Corona Virus. It is close to being called a pandemic which may have an even greater impact on the economy and my investment.

This period has made me question the ‘timing’ of my investment. I understand that it will probably recover from this COVID crash and maybe in a few months I will be back on track to positive gains and I’ll forget this time happened. But the one thing that I find hard to ignore is that a recession could occur and it will totally nullify my money for years at a time.

If it’s true that recessions are inevitable, then it makes long-term investment seem foolish. You essentially have to invest after a recession and sell before it. Otherwise you will be riding the recession down, waiting for it to recover, returning to your original investment value, waiting for growth, and then by that time you are ready for the next recession. I have to confirm whether this is the case. But it seems like investment goals with 10+ year timeframes in a world where recession occur every 10 years or so seems like bad idea.

Despite all my concerns and uncertainties, I went ahead and made a $20,000@$60.13 investment into VDHG. It seems like a crazy sentence to write – “I was very worried but I spent $20,000 anyway”. Normally I would think this is something an idiot would say or someone who has been succesfully conned. But I have the feeling that the first investment of this size is going to come with a lot of uncertainty anyway. In fact, I’m convinced that this is a normal and healthy attitude to have when dealing with large sums of hard-earned money.

Since the investment was in VDHG, I wasn’t worried about a sudden loss due to regular market fluctuation. It is so well diversified that its day-to-day changes are only about 0.5% (very very roughly – [Don’t trust me; do your own research]). This investment is intended to be a long term investment over 10 years or more. So, fluctuations over days or months ought to be ignored. The strategy is to follow the market’s natural incliniation to grow over years and years.

Therefore, my main, and perhaps only, fear was that we are about to enter a recession and my money would immediately start to see losses. The strategy of long term investment is supposed to ignore recessions as the market will inevitably recover and your investment will continue to grow. This would console me, but the other fear is that I would be investing at the ‘wrong time’. If I were to just wait a few more months, maybe the recession would begin and I could use that $20,000 to invest when everything is cheap, and then my gains would be triple-fold.

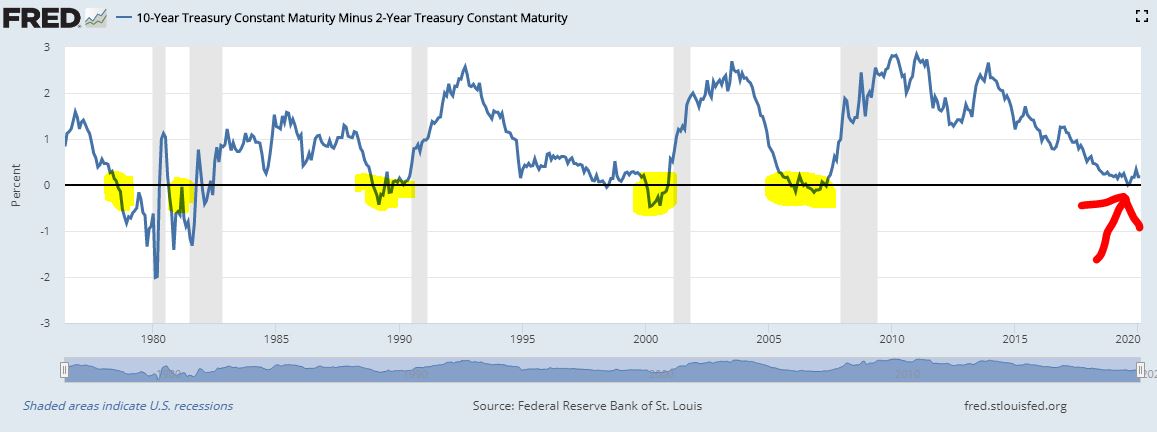

I wasn’t scared by random recession talk or hype from the news about current affairs causing issues in the market. I was scared by the ‘inverted yield curve’. It is supposed to be predictive of all but one of recession of the past.

The highlighted yellow sections show the ‘inverted yield curve’ and the grey areas represent recessions. Currently, at the red arrow, our yield curve seems to have inverted. This seems like a real threat and a real sign of a recession. But no one can agree on anything and everyone treats the market as unknowable. I find it very hard to ignore this graph and have no idea how I should interpret it.

Essentially, I coneded that we may enter a recession in the near future, but I have no idea when it will happen.

So, I decided if we immediately enter a recession as I invest, then I will treat it as a long term strategy and just ride it out. I would still have opportunities to earn money and invest it during the recession. The alternative scenario is that we have a recession in one or two years. During that time my ETF will have gained value and dividends. If we enter a recession at that later stage, I may have time to sell at that point – at a profit – and have even more capital ready to invest during the downturn. (Although I think it is generally advised to avoid panic selling at times like that – but at least this makes me feel a little safer in the knowledge that my money isn’t entirely doomed.)

The lack of knowledge about when the recession could begin; how deep it could be; and how long it could last are all reasons to fear entering the market. But they are also reasons for why entering NOW is a good idea.

In saying that, I am prepared for my attitude to change if things go wrong, and I will use this blog to record my regrets and warnings to my future self. It’s hard to know if I am being greedy and impatient, or strategic and prepared.

This will simply be the records of my journey in starting off investing.

It is probably going to be relatable to anyone who is starting to look at investing and still isn’t sure if ‘stock’ and ‘share’ mean different things. I don’t know, but I don’t think it matters.

There’s a lot I don’t know and I don’t aim to become an expert. It is very likely that my first investment won’t be totally well-thought out, and will come with a lot of issues, regardless of how much time I put into deciding what to invest in.

I don’t intend for this to be a guide in learning how to become a master investor. It has a pretty specific intention: to follow my thought process regarding a 20k investment into an ETF (VDHG). I am already a few steps into the process, but there is still one thing holding me back: fear of recession.

I get the sense that I am going to go through with the purchase based on a long-term (10~ year) investment plan which will ride out any potential recession. And so I want to have this blog ready for when I panic and regret things and think about changing my mind. If anything, it will allow me to make decisions more slowly by reflecting; and also allow other new investors to learn something and maybe know that these panicked feelings are normal (and inconsequential?).

My next post should hopefully be when I have made the purchase and then I will have time to describe what brought me to do it; what was holding me back; whatever else is relevant.

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.